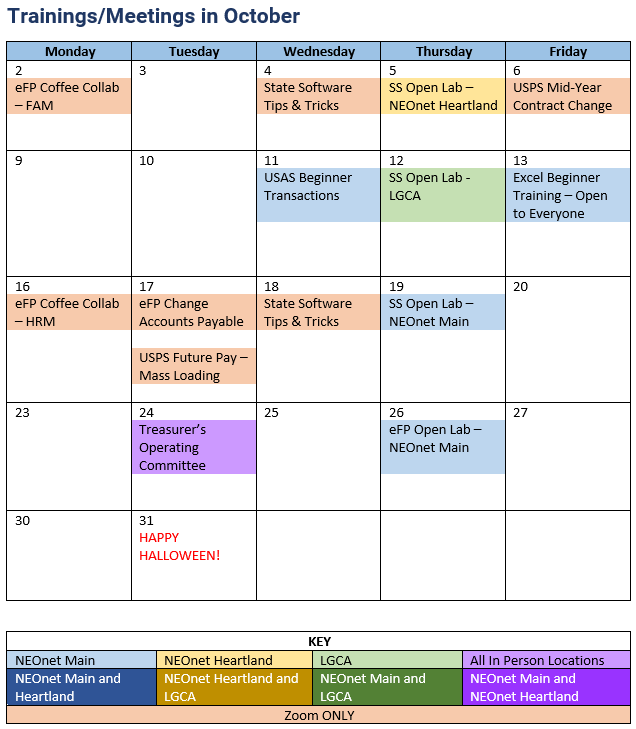

September 2023 Monthly Update

Important Update on Post-Tax SERS Contributions

If your district has post-tax deductions, we strongly advise generating your check history report and cross-referencing it with the post-tax SERS Contribution amounts under the eSERS Contribution report.

The contribution amount under the eSERS Contribution report should match with those in the Check History report, however if you find any discrepancies between the two reports, you will need to correct the amount on the eSERS Contribution Report to match what is on the Check History before submitting your file.

PowerSchool is currently working on a fix affecting post-tax SERS contributions. While a specific release date for the fix has not been confirmed, we let you know when there is a resolution.

Making Temporary Budgets Permanents in USAS

If you adopted your Temporary Appropriations on or before July 1st, you may now be getting ready to finalize the budget by adopting your permanent appropriations. In order to determine if these appropriations were actually applied in the USAS application as temporaries or permanents, let’s first download the report definitions from the Public USAS Reports Library to help us.

- Budget Transactions Initial Estimates.rpd-json

- Revenue Transactions – Initial Estimate.rpd-json

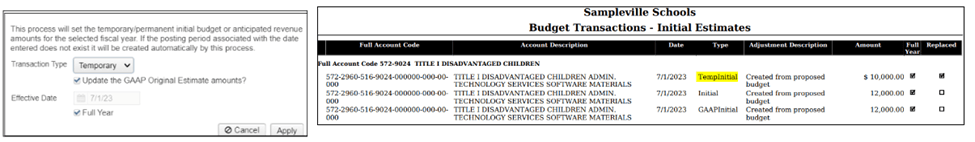

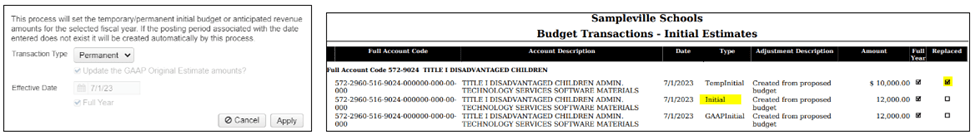

After downloading these report definitions and importing them into the USAS Report Manager grid, you can generate these reports to view the changes made to the account’s initial estimates when the proposed amounts were applied in USAS. By viewing the report’s ‘TYPE’ column, you can determine the type of transaction that was applied. The report will show whether these amounts were applied as initial temporary (full year or not full year) or permanent transaction types.

Let’s look at the options when applying the proposed amounts in USAS as well as how the above report definitions can help determine the applied budget/revenue transaction types.

- If you selected the transaction type of Temporary when you applied your proposed amounts (left image above), the amounts applied became your (temporary) Initial budgets for the fiscal year chosen and will be labeled TempInitial on the Budget Transactions Initial Estimates report (right image above).

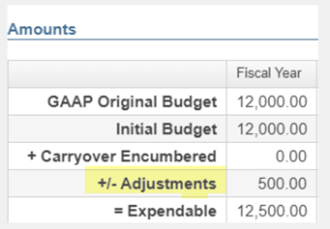

- If the Update the GAAP Original Estimate Amounts is left checked (by default), it will apply the current expendable/receivable amounts [Initial amounts + (CO Enc) +/- Adjustments] to your GAAP Original Budget figures on the account. They will be labeled as GAAPInitial on the Budget Transactions Initial Estimates report. If you do not want your GAAP amounts updated, the box can be unchecked.

- If Full Year was left checked, this indicates the temporary amounts hold true for the entire year. If your temporary amounts are going to change during the year, you can uncheck the full year box before applying.

- The Replaced column indicates whether or not the temporary amounts were replaced with a permanent amount.

Now that the Type of transaction has been determined, if no changes to the Temporary amounts are needed, it is up to the user to decide if they want to apply these amounts as Permanent amounts in the application. The Initial amounts will not change on the account, but can show on certain reports that include the TYPE like the report above.

- If applying Permanent amounts, the transaction type of Permanent should be chosen and the temporary amounts on the accounts will be overwritten.

- The Replaced box is checked next to the temporary amount (TempInitial) signaling that the temporary amount has been replaced with a Permanent (Initial) amount.

- When you select the transaction type of Permanent, the Update the GAAP Original Estimate Amounts is checked by default and cannot be changed, enforcing the current expendable/receivable amount will be applied to your GAAP Original Budget on the account. If the checkmark was set on the Update the GAAP Original amounts during your temporary posting, when applying permanents, the GAAP ‘original budget’ on the account remains unchanged; however, the GAAP ‘revised budget’ amount reflects the permanent figure when using the GAAP Extract option in USAS.

- You may wonder what happens if there are adjustments already posted to the accounts before you apply your Permanent amounts? Whether these adjustments were posted under the Core<Accounts or the Proposed Amounts grid with the transaction type of Adjustment, adjustments do not affect the initial figures. (NOTE: Adjustments are not included on the Budget Transactions Initial Estimates report). Adjustment amounts update additions/deductions on the account which, in turn, updates the FYTD expendable/receivable amounts. When applying Adjustments via the Proposed Grid, you must select the effective date for these adjustments and the Update the GAAP Original Estimate Amounts is unchecked by default. If the GAAP amounts should be overwritten on the accounts with the new expendable/receivable amount, check the box. The GAAP Original Budget will stay the same but the GAAP revised budget on the GAAP extract option in USAS will reflect the adjustment.

Therefore, using the above example, the Temporary Initial and GAAP Initial was $10,000 for the full year, replaced with the Permanent amount of $12,000, and included an adjustment of $500 which leaves $12,500 as the expendable amount on the account. (Current Expendable Amount = Initial $12,000 + $500 positive adjustment)